Japanese organizations recently completed construction on a new carbon capture project at the Wyoming Integrated Test Center, underscoring joint energy priorities and challenges.

Japan Carbon Frontier Organization (JCOAL) and Kawasaki Heavy Industries (KHI) celebrated the completion of their solid sorbent carbon capture technology at the Wyoming Integrated Test Center (ITC) in Campbell County on October 9th. The project broke ground at the Dry Fork Power Station in May 2023 and was facilitated by a Memorandum of Understanding (MoU) signed between JCOAL, KHI, and Wyoming in 2020.

The JCOAL-KHI project has been funded primarily by the Japanese Ministry of the Environment. Although public figures are not disclosed, ITC administrations believe the life of the project will cost between $15 and 20 million. Much of the money is allocated for fabrication, construction, and eventual decommission of the project’s equipment.

The ceremony to celebrate the completed construction came on the same day the University of Wyoming School of Energy Resources (SER) inked an MoU with JCOAL to strengthen their partnership in applied energy research. Particularly, the MoU will allow both entities to share technical expertise and collaborate on future projects revolving around carbon capture, utilization, and storage technology (CCUS) and rare earth minerals.

Coal and Carbon Capture Technology in Wyoming

Wyoming is the largest coal-producing state in the United States, comprising around 41.2% of all national production in 2022. The state government heavily depends on fossil fuels for its public services, with 60% of its revenue coming from oil, gas, and coal. Remarkably, the state produces almost 12 times the energy it consumes. Considering how integral fossil fuels are to the economy of Wyoming, many of the state’s political representatives have been skeptical or outright hostile to legislation such as the Inflation Reduction Act (IRA) which prioritize supporting renewable technologies over fossil fuels.

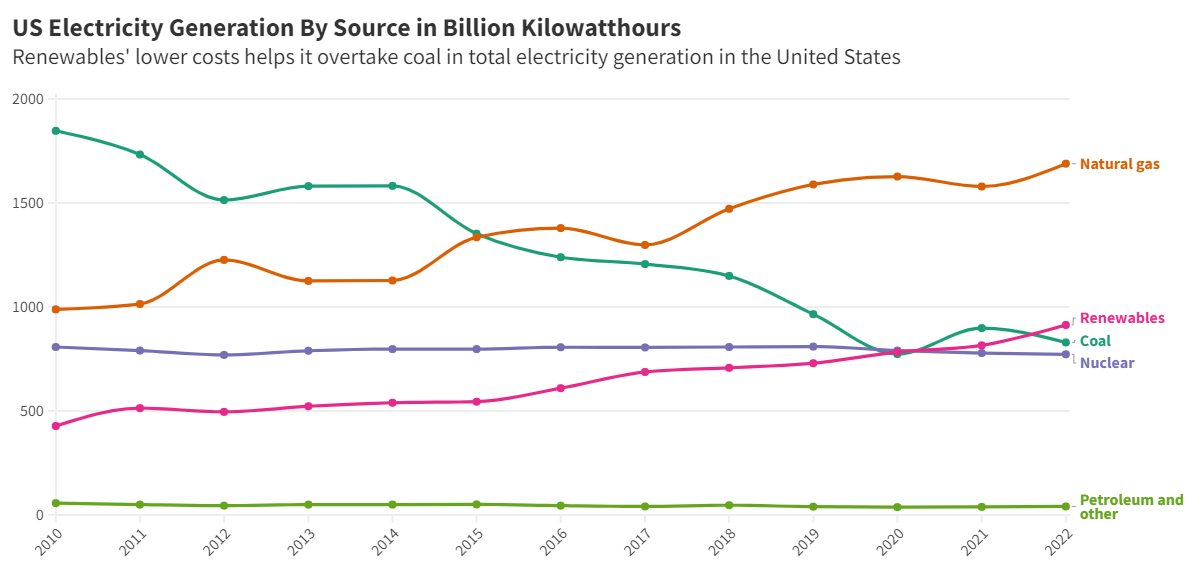

Although recent federal clean energy tax incentives are hastening the closure of coal plants and environmental rules have played some role in the decline of the industry, the evolving economic landscape of US energy production over the past twenty years has primarily led to coal’s waning fortune. Major changes include productivity improvements in natural gas production, reducing its cost as a fuel source, alongside a notable decrease in solar and wind power costs. Such monumental changes enabled renewable energy to overtake coal as a larger source of electricity generation in the United States in 2022 – before the IRA was passed.

Source: US Energy Information Administration; Interactive Graphic Link

Wyoming leaders have noticed these fundamental changes and responded not just with resistance, but with investment it believes will preserve the state’s energy industry. Many of these investments are in CCUS technologies, which aim to capture carbon dioxide emissions from sources like coal-fired power plants and either reuse or store them so they will not pollute the atmosphere.

For example, former Governor Matt Mead announced in 2015 a $15 million carbon capture test facility to be built at Dry Fork Station, which ended up being the ITC – one of only two testing facilities in the United States that can help developers test and scale their CCUS technologies on natural flue gas for commercial deployment. The facility has attracted developers from all over the country and the world, including California-based Membrane Technology and Research Carbon Capture and Japanese entities.

Japan Struggles to Reconcile Energy Needs and Climate Concerns

Wyoming's approach to the energy transition, which involves acknowledging inevitable shifts in energy markets and attempting to balance a significant dependence on coal, mirrors the strategy being pursued by Japan – the third largest coal importer in the world with the source responsible for one-third of its electricity generation in 2022.

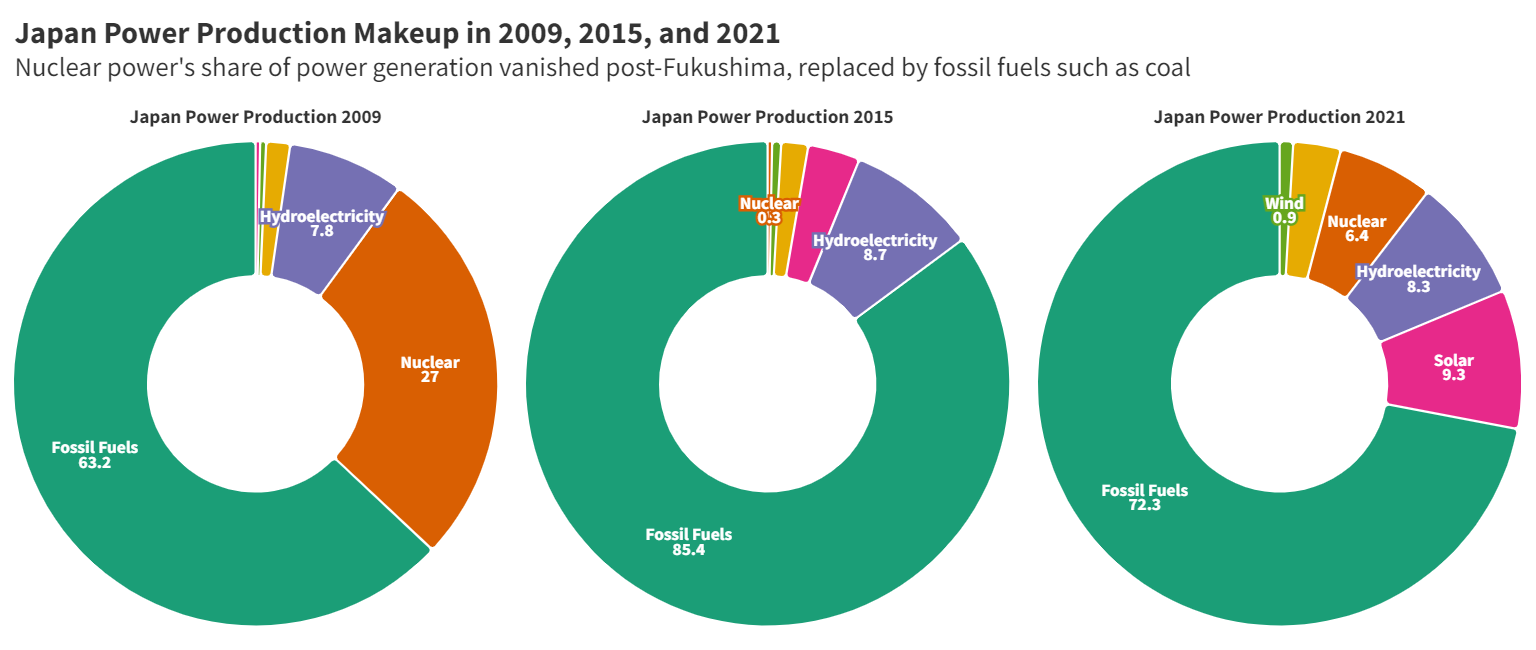

Much of this coal consumption has been on the rise for decades since the oil shocks of the 1970s, making it complicated to transition away from the fuel source. However, after the Fukushima nuclear disaster, Japan shut down most of its nuclear plants, which comprised around a third of electricity generation at the time. This caused the country’s power producers to dial up generation from fossil fuels, particularly coal. Since 2011, Japanese companies constructed 40 coal plants – nearly a quarter of the country’s total coal-fired plants – with two new ones coming online in 2022: Takeyoto No.5 and Misumi Power Station Unit 2.

Source: US Energy Information Administration; Interactive Graphic Link

Considering the continued use of coal, paired with ambitious goals to reduce greenhouse gas emissions by 46% in fiscal year 2030 from 2013 levels, Japan has attempted to reconcile these dueling commitments to energy security and climate action. For example, on a small island called Osakikamijima, a decade-long project managed by Osaki CoolGen to make burning coal more environmentally friendly was backed by $384 million of public funding. There were three stages to the project, where notably in the second stage a cheaper method of carbon capture technology was used to lower carbon emissions by 90%. There are plans to use the findings of Osakikamijima to retrofit J-Power’s 42-year-old coal plant in Nagasaki, hoping widespread viability for the tech will follow commercial operation in 2026.

Despite the construction of numerous coal-fired plants in the past decade and efforts to retrofit plants with CCUS technology, 13 planned plants have been canceled since 2012 due to the unprofitability of the source and shrinking electricity demand. The country has pledged to shut down 100 more inefficient plants by 2030. Such changes could leave Japan with $61-80 billion worth of stranded coal assets. Coal is struggling to compete, and it remains to be seen if CCUS can alter that.

Challenges and Opportunities with Wyoming-Japan Converging CCUS and Coal Interests

The shared reliance on coal and mutual affinity for investing in CCUS technology have been the driving forces behind enhanced cooperation between Japan and Wyoming. Such converging interests were reflected in 2016, where then-Wyoming Governor Matt Mead and Osamu Tsukamoto, President of JCOAL, signed an MoU to partner in coal, research, technology development, and coal trade. This general MoU was renewed in 2021 and was the basis for the 2020 MoU between JCOAL, KHI, and Wyoming which facilitated the JCOAL-KHI project.

However, it is important to note that both Wyoming and Japan have faced challenges and significant criticism regarding the funding of CCUS technologies for power generation and initiatives to produce cleaner coal.

In March 2022, utilities governed by a Wyoming law mandating power generation from coal plants to be equipped with carbon capture technology reported to regulators. These submitted filings indicated the technology was not economically viable and implementing it would lead to increased electricity bills for customers. This contrasts sharply with the potential for approximately $7.1 billion in economic growth and the creation of 4,700 new jobs in Wyoming, predominantly through renewable energy projects, particularly wind power, if the necessary permits are obtained and construction is completed.

Similarly, a new study found that Japan’s hydroelectric and offshore wind capacity could create a 100% self-sufficient renewable grid with competitive prices. Some other projections show how 67,000 new jobs related to clean energy could be created by 2050. However, this potentiality is stymied by the structure of the Japanese power market. The country does not have a national grid; instead, it has 10 separate companies operating autonomously that shut out renewables and artificially drive prices of them up compared to other industrialized nations.

These factors have led critics to argue that supporting CCUS technologies in coal-fired power generation, coupled with investments in questionable methods like ammonia combustion, represents economically inefficient strategies. They believe these approaches serve to sustain the use of dirty fossil fuels such as coal, catering to the interests of long-established fossil-fired industrialists and utility companies as opposed to the public in both Wyoming and Japan.

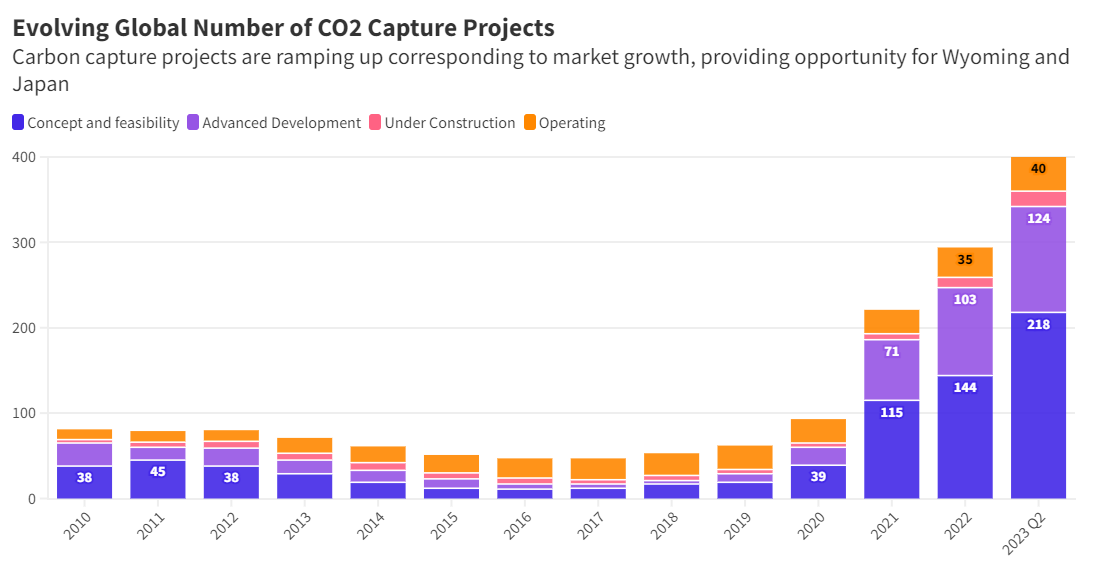

Nevertheless, even if current effectiveness and value of CCUS technologies in coal-fired power generation is questionable, the development of these technologies and their potential adaptability for other applications hold economic promise as an industry for both Japan and Wyoming. This is evidenced by how the global market for CCUS technologies is projected to grow from $3.0 billion in 2022 to $14.2 billion by 2030.

Source: International Energy Agency CC BY 4.0; Interactive Graphic Link

The United States has contributed to the boosting of this industry, announcing new funding under the Infrastructure Investment and Jobs Act (IIJA) and favorable CCUS tax credit alterations in the IRA. Wyoming has already attempted to capitalize on these changes, announcing the world’s largest carbon removal project called Project Bison after passage of the IRA. The goal for the project is to draw down 5 million metric tons of carbon dioxide annually by 2030, and for Wyoming to potentially manufacture carbon capture modules one day too. Meanwhile, the University of Wyoming received the largest of nine federal grants to develop carbon storage hubs across the country.

Likewise, the Japanese government announced financial support for seven CCUS projects in June 2023. Five of the seven development plans to store carbon dioxide are in Hokkaido, the Sea of Japan, Greater Tokyo, and Kyushu, whereas the other two revolve around transporting and storing the chemical overseas in Malaysia and Oceania. The plan is that by 2050, Japan will have enough capacity to store 120 million to 240 million tons of carbon dioxide per year from hard-to-abate sectors, including power, steel, and chemicals.

These national endeavors focusing on CCUS technology for a variety of usages have been replicated in bilateral cooperation. For example, the Wyoming Infrastructure Authority entered an MoU with JCOAL as well as GreenOre Clean Tech LLC and Columbia University on a project related to decarbonizing construction and/or paper production in 2019.

The energy transition to net-zero in both countries is a machine with many cogs, and CCUS technologies will be one of them. Indeed, the International Energy Agency (IEA) recently concluded that “achieving net-zero goals will be virtually impossible without CCUS.” The aforementioned bilateral projects aim to position Japan and Wyoming as the forefront beneficiaries of this critical industry. Considering their respective commitments to developing these technologies, further cooperation has immense potential.

Matthew Willis is a Young Professional at the East-West Center in Washington. He is an undergraduate student at the University of Texas at Austin, majoring in International Relations, Economics, Government, and East Asian Studies.