TerraPower and Mitsubishi expanded their agreement on the development of advanced nuclear reactors, indicating the source’s continued role in the United States and Japan’s energy goals.

Japan Atomic Energy Agency (JAEA), Mitsubishi Fast Breeder Reactor Systems (MFBR), Mitsubishi Heavy Industries (MHI), and TerraPower expanded their Memorandum of Understanding (MoU) in developing sodium-cooled fast reactor (SFR) technologies.

This enhanced agreement, building on the 2022 pact, enables TerraPower and Japan to jointly explore the development of a unified reactor design, integrating the strengths of Japan's fast reactor (FR) demonstration program with the technologies of the American company. More specifically, the MoU will allow an increase in the size of the Natrium – a new type of modular SFR design developed by TerraPower and GE-Hitachi. These changes will presumably boost cost competitiveness and fuel safety of the designed plant.

Similarly, the goal of extended collaboration for TerraPower will be to acquire the know-how and test facilities of JAEA related to fast reactors. Conversely, the Japanese entities involved in this collaboration will benefit from TerraPower's cutting-edge technologies and specialized knowledge in safety measures. This exchange of information and skills is particularly crucial for Japan as they are progressing towards developing their own demonstration reactor.

These arrangements are anticipated to hasten the commercialization of next-generation reactors—a key objective for both nations—by leveraging the combined expertise of Japanese and American teams.

TerraPower, Wyoming, and Nuclear in the United States

Currently, there are no nuclear FRs which deliver electricity commercially in the United States. TerraPower is one of the companies attempting to change this, as in 2021, it announced it would cooperate with PacifiCorp to develop its 345-megawatt SFR coupled with a molten salt-based integrated energy storage system called the Natrium in Kemmerer, Wyoming. The plant has public and private sector support, securing $830 million from the latter in 2022 and around $2 billion from the US Department of Energy (DOE).

As for the economics of the plant, it is estimated to be a $4 billion project with a promise to provide opportunities for a region that long relied on a diminishing coal industry to power its economy and fund its public services. Corroborating this potential, the company surmised the project will be expected to have a peak workforce with 1,600 jobs and 250 full-time employees after that initial phase to support the day-to-day functions of the operating plant.

The hope is that economic success resultant from TerraPower’s project will usher in a new generation of nuclear power plants in the United States.

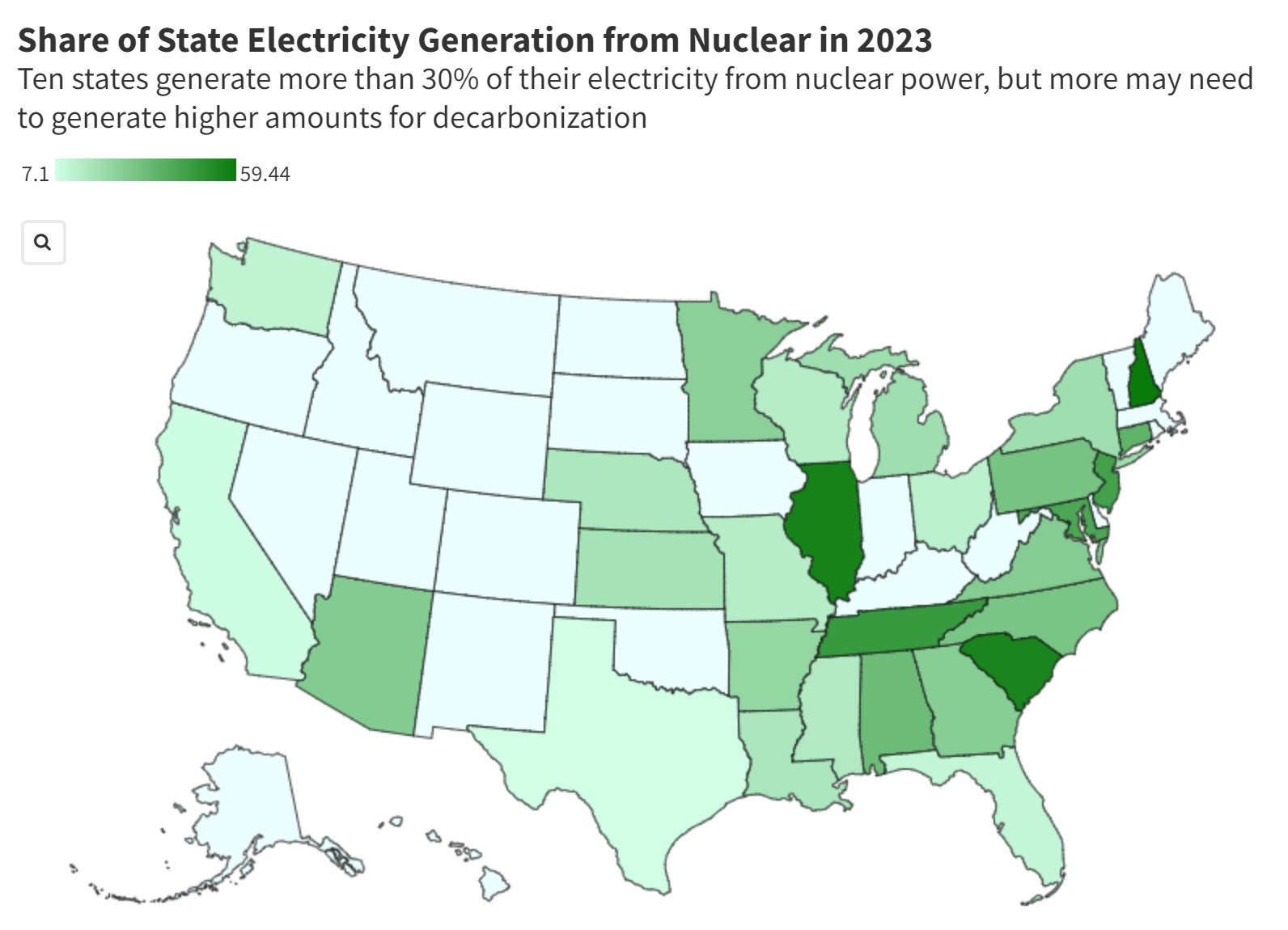

Since 2012, 11 out of 104 traditional light-water reactors have closed, primarily due to the inability to compete with lower solar, natural gas, and wind costs, as well as aging infrastructure. Nuclear has remained roughly responsible for 20% of electricity generation in the United States for four decades. Despite these closings and stagnation, the DOE anticipates the United States will need to triple nuclear energy production to about 300 gigawatts by 2050 to meet national decarbonization targets. That growth is projected to be driven by advanced nuclear technologies, such as FRs and other small modular reactors (SMR) similar to Natrium.

Source: US Energy Information Administration; Interactive Graphic Link

Some advantages of the next-generation reactors are their smaller sizes, reduced amount of nuclear waste, and more efficient fuel usage as well as recycling. For example, the Natrium is projected to be around one-third the size of a traditional light-water reactor design, aiming for cost savings and reducing the scale of an accident in a potential event. Similarly, these smaller sizes allow for standardization and fabrication of their constituent parts assembled in a factory environment. This is in contrast to the current massive light-water reactors, which require extensive customization.

The federal government has noticed the potential of these next-generation reactors as a fuel source, pouring many resources from recent laws into the industry. The Infrastructure Investment and Jobs Act (IIJA) provided $2.4 billion to support DOE awards for support, design, licensing, and construction of two advanced reactor technologies, including the TerraPower reactor and X-energy Xe-100 reactors. Likewise, the Inflation Reduction Act (IRA) provided ten years of certainty to commercialize advanced reactors through a 30% investment tax credit and made tens of billions of dollars in Title 17 loan guarantees available for nuclear projects.

Japan, Nuclear Nerves, and Decarbonization Desires

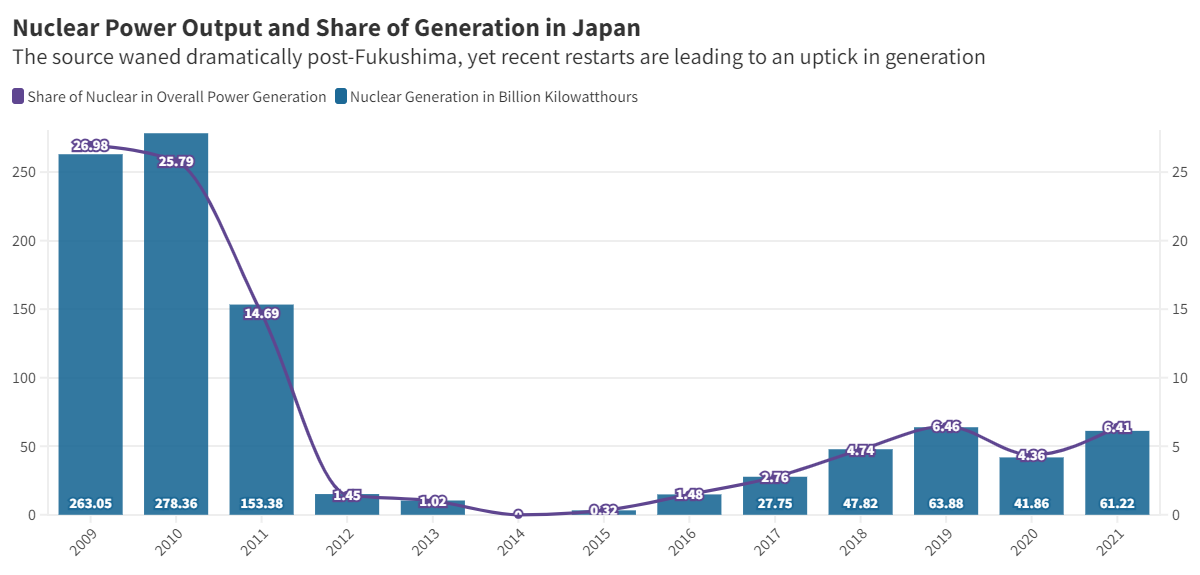

Until 2011, Japan generated around 30% of its electricity from nuclear reactors and had plans to increase this to at least 40% by 2017. However, the meltdown of the Fukushima Daiichi power plant after the Great East Japan Earthquake and Tsunami radically altered these plans. Nuclear power receded, dropping to 0% of total electricity generation by 2014. The nation’s import dependence rose, with 97% of its demand being met through external sources due to its limited domestic resources.

This import dependence, along with the COVID-19 pandemic and the Russo-Ukrainian War, contributed to inflation and fuel issues, slashed the profits of utility companies, weakened the yen, and impacted consumers. These conditions, along with a global drive to decarbonize and prevent warming of the planet by 1.5°C above pre-industrial levels, prompted Prime Minister Fumio Kishida to recently codify a ten-year roadmap for the nation’s energy transition titled “GX,” or “Green Transformation.”

A core part of this strategy involves restarting older nuclear plants and developing advanced reactors for the future.

Utility companies applied for restarts at 27 reactors in the past decade. Out of these, many have passed safety checks and around 12 out of the entire previous fleet of 33 have resumed operation. Analysts have claimed that a million metric tons of LNG imports a year are trimmed for each gigawatt of nuclear power restarted. The projected benefit of turning on seven reactors would give Japan’s nominal GDP a boost of around $4.1 billion annually.

Source: US Energy Information Administration; Interactive Graphic Link

Likewise, the Japanese government revised its Strategic Roadmap for FR development in December 2022 with two decisions. The first was to select an SFR as the basis of the conceptual design for a demonstration reactor to begin in fiscal year 2024, whereas the second was to select a manufacturer as the core company in charge of the design and R&D. This came to fruition where MHI was selected to lead conceptual design for a 650 MWe SFR reactor for operations in the 2040s. It is hoped the concept will be finalized by 2030.

Even the public has come around to recentering nuclear energy as part of a national energy strategy. Asahi found in February 2023 that 51% of respondents favored resuming operations for idle plants, while 42% said they wanted them to remain idle. Building new reactors remains contentious, with 45% in favor and 46% opposed, but these numbers have improved compared to years ago.

Critiques and Challenges in Binational Advanced Nuclear Development

Despite these shared strategies to promote the nuclear power industry, Japan and the United States will contend with a variety of challenges associated with restarting older reactors and supporting next-generation technologies.

Firstly, High-Assay Low-Enriched Uranium (HALEU) fuel required by Natrium and other advanced nuclear reactor designs has come in short supply on an international level. Following Russia's invasion of Ukraine, TerraPower severed its relationship with Russian state-owned Tenex - the only global supplier capable of providing HALEU in commercial quantities. Such changes pushed the operational date of TerraPower’s plant from 2028 to 2030. Scrambling to find other sources, TerraPower and the DOE agreed to provide an initial investment of $200 million for a fuel facility at Global Nuclear Fuel-Americas' (GNF-A) existing enrichment location near Wilmington, North Carolina in October 2022.

However, the DOE estimates more than 40 metric tons of HALEU will be needed by the end of the decade, with additional capacity each year thereafter. Capabilities for producing this fuel are low in the United States, and it is unclear whether the private sector will risk much on an industry in its infancy, even with federal investment. Considering Japan has low domestic resources and a high dependency on energy imports, sourcing more materials for new reactors becomes arduous for the nation too.

The second issue lies with the potential costs of unproven advanced reactor designs. Eight countries have collectively spent more than $100 billion trying to produce a commercially competitive sodium-cooled reactor in the past 60 years, with limited success. This includes the United States, where in the early 1980s, millions ballooned to billions on a project to develop a SFR near the Clinch River in Tennessee. Construction halted in 1983.

Further cost issues have been accentuated by recent studies, where in March 2023, Colorado State University researchers suggested the economics for SMRs would not be dramatically better than those for already expensive large reactors. For example, NuScale was constructing an SMR in Idaho with support from the DOE. However, it was recently canceled due to ballooning costs, rising from $5.3 billion to $9.3 billion. Chubu Electric Power Company had bought a stake in the company before this closure, but considering its failure, this investment could be seen as questionable.

In addition to this, it is unclear whether SFR designs are safer. JAEA has a history of operating them, such as Monju in Fukui Prefecture and the Joyo experimental SFR in Ibaraki Prefecture. However, Monju was shut down in 1995 after a sodium coolant leak and fire. It was restarted in 2010 but was shortly shut down after a fuel handling machine accidentally dropped into the reactor during a refueling outage.

Likewise, Joyo shut down in 2007 after a test sub-assembly became jammed in the reactor vessel. Special equipment had to be designed to retrieve it, which finally took place in 2014. Joyo will restart after the Nuclear Regulation Authority (NRA) determined it met new regulatory standards, but critics contend that the agency lacks teeth when political winds are behind a decision, such as supporting SFRs.

As for in the United States, a report from the Union of Concerned Scientists (UCS) believes that plants which rely on sodium could encounter problems not possible for traditional light-water reactors. Sodium coolant, for instance, can burn when exposed to air or water, and the Natrium’s design could experience uncontrollable power increases that result in rapid core melting.

This report also brought up another critical issue, which is how these SFRs may not reduce the amount of waste which would require long-term isolation. Neither country has figured out a method for storing nuclear fuel waste. There is no repository for spent nuclear fuel in the United States and the issue has eluded Congress for decades. Japan is planning to process the spent fuel and seal radioactive waste in glass, enclose it in steel containers, and bury it in bedrock underground. It also plans to host storages sites in villages in Hokkaido. However, safety debates continue, and the issue is problematic in a country with continued local opposition.

Bilateral Potential

Nevertheless, Japan and the United States see benefits in advanced nuclear development.

One of the key benefits of nuclear power compared to renewables like solar and wind is its ability to provide a consistent energy supply. Nuclear power plants can produce electricity continuously, 24/7, regardless of weather conditions or time of day. This contrasts with renewable sources like solar and wind, which are intermittent and depend on environmental factors such as sunshine and wind speed.

Japan faces unique challenges in adopting renewable energy sources like wind and solar due to its limited geographic space and challenging topography. The country's steep coasts and deep waters make installing renewable energy infrastructure, particularly offshore, more expensive compared to regions like the East Coast of the United States. Additionally, Japan's mountainous landscape limits the availability of suitable land, most of which is already utilized for agriculture or urban development.

This situation hinders scalability of wind and solar projects. In contrast, the United States benefits from vast expanses of land, allowing for development of thousands of wind and solar projects across various regions. Given these constraints, Japan sees deployment of SMRs and SFRs, which require less space with substantial energy generation, as offering a viable alternative.

Similarly, in communities dependent on fossil fuels, nuclear power presents a revitalization opportunity that might be more challenging for renewable sources. For example, older grids do not have the necessary transmission lines and batteries to store excess renewable power. Nuclear power is thought to be more flexible with existing grids, which are expensive to upgrade, due to its consistent output. This is partly driving Japan to restart many older reactors, as economists view restarting existing reactors as a realistic and cost-efficient way to lower emissions.

Even with building newer reactors, the local benefits could be immense. Sited near a retiring coal facility, the Natrium project in Kemmerer is thought to be one of the few coal-to-nuclear projects under development in the world. The Interagency Working Group on Coal and Power Plant Communities and Economic Revitalization (IWG) has pinpointed 25 communities like Kemmerer as top priorities for grant allocation and fostering investment initiatives. Nuclear could expand to many of them to create jobs and prevent rural depopulation and decline, which Japan is also struggling with.

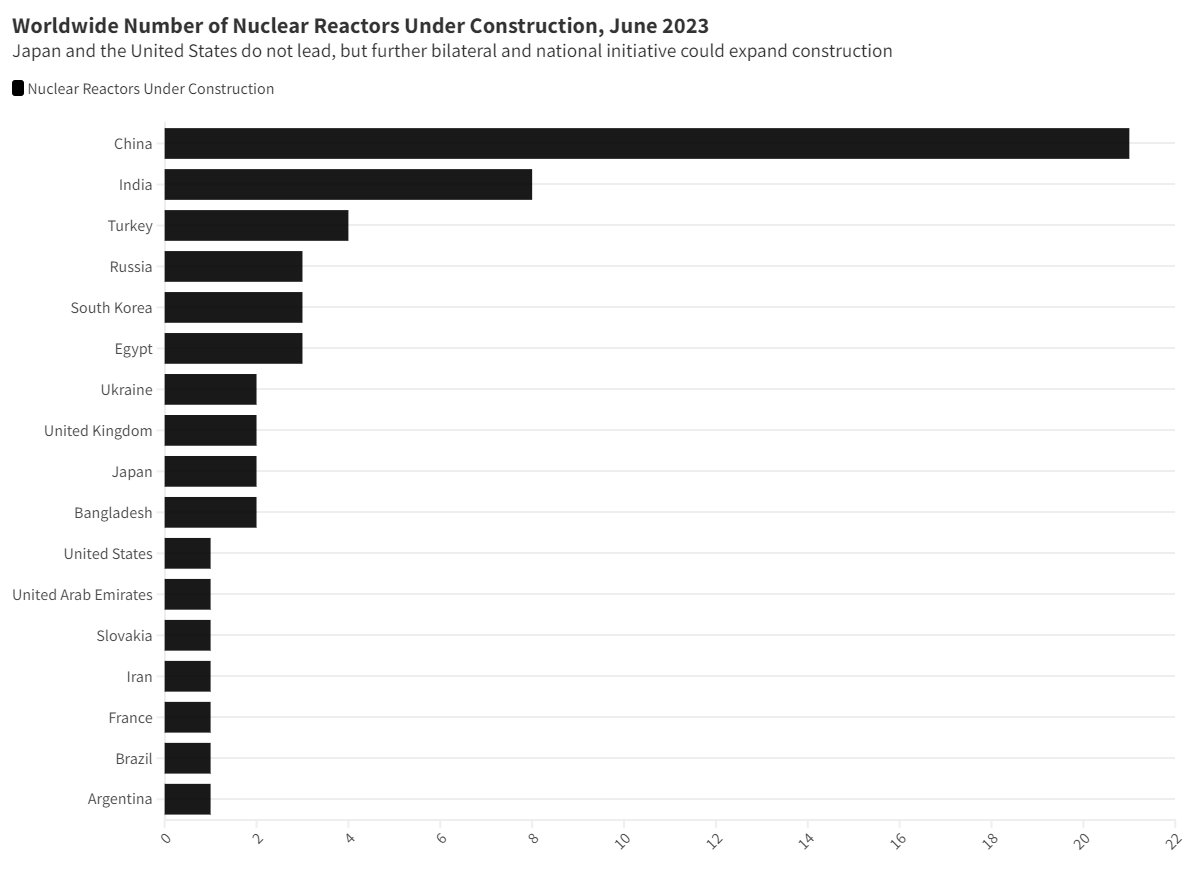

Source: International Atomic Energy Agency; Interactive Graphic Link

Lastly, both Japan and the United States are keen to lead the global nuclear industry, especially considering forecasts that suggest worldwide nuclear power generating capacity might more than double, reaching 890 gigawatts (GW) by 2050 from the current 369 GW. Even under more conservative projections, this capacity is expected to rise to 458 GW. Such significant growth not only presents opportunities for local community development, as mentioned, but also holds the potential for widespread economic benefits.

The potential advantages of nuclear energy have spurred bilateral collaboration, exemplified in January 2023 when energy ministerial discussions culminated in an agreement to develop and construct next-generation advanced reactors. Similarly, in October 2022, the two governments unveiled a joint initiative to deploy a SMR in Ghana, reflecting their commitment to international cooperation in the nuclear sector.

Creative solutions brought forth through bilateral cooperation are needed to harness nuclear power as part of the energy transition. It remains to be seen if it can be harnessed considering immense challenges, but the potential of nuclear is present and growing for both the United States and Japan.

Matthew Willis is a Young Professional at the East-West Center in Washington. He is an undergraduate student at the University of Texas at Austin, majoring in International Relations, Economics, Government, and East Asian Studies.