Double taxation has been hindering opportunities for cooperation and investment between the US and Taiwan. The newly proposed bipartisan Taiwan Tax Agreement Act of 2023 could change the rules of the game, fostering stronger ties and creating opportunities for businesses on both sides.

In the heart of the Arizona desert, the Taiwan Semiconductor Manufacturing Company Limited (TSMC)'s new $40 billion chip factory is emerging as one of the largest foreign investments in US history, creating over 10,000 construction jobs and 10,000 high-tech jobs. But, as the Taiwanese semiconductor giant prepares to open the factory in 2024, they face a significant obstacle: double taxation.

With no tax treaty existing between Taiwan and the United States, TSMC is set to lose more than half of its profits earned in the United States, while other companies like Samsung, with the benefits of a comprehensive US-South Korea tax agreement, pay significantly less.

US policymakers who want Taiwanese firms like TSMC to expand in the United States have urged President Biden to negotiate with Taiwan and ease the double taxation burden. In March 2023, Treasury Secretary Janet Yellen admitted that the lack of a tax agreement with Taiwan remains a “very significant problem” for the Biden administration.

In May 2023, US Senators Bob Menendez (D-N.J.) and Jim Risch (R-Idaho), Chairman and Ranking Member of the Senate Foreign Relations Committee, along with Senators Chris Van Hollen (D-Md.) and Mitt Romney (R-Utah), Chairman and Ranking Member of the Subcommittee on East Asia, the Pacific, and International Cybersecurity Policy, introduced the Taiwan Tax Agreement Act of 2023. This bipartisan legislation authorizes the Biden administration to sign a tax agreement with Taiwan, making it easier for businesses in the United States and Taiwan to avoid double taxation and protect against tax evasion.

US Senator Jeanne Shaheen (D-NH) – a senior member of the Senate Foreign Relations and Armed Services Committees – has joined the force to push for the tax agreement. House Ways & Means Committee Chairman Jason Smith (R-MO), Senate Finance Committee Ranking Member Mike Crapo (R-ID), House Ways and Means Ranking Member Richard E. Neal (D-MA), and Senate Finance Committee Chairman Ron Wyden (D-OR) also announced a bipartisan, bicameral effort to alleviate double taxation between the United States and Taiwan.

The recently proposed bill emphasizes the role of Taiwan as a significant economic partner for the United States. Taiwan is America’s eighth-largest trading partner, and American exports of goods and services to the island support at least 188,000 American jobs. In addition, Taiwan's cumulative investment in the United States is over $13.7 billion.

However, American companies operating in Taiwan – particularly those in the crucial tech sector – have suffered from double taxation. Furthermore, the potential impact of double taxation leads US companies to avoid the use of “drop shipments” from contract Taiwanese manufacturers directly to final U.S. customers, inconveniently lengthening the supply chain process.

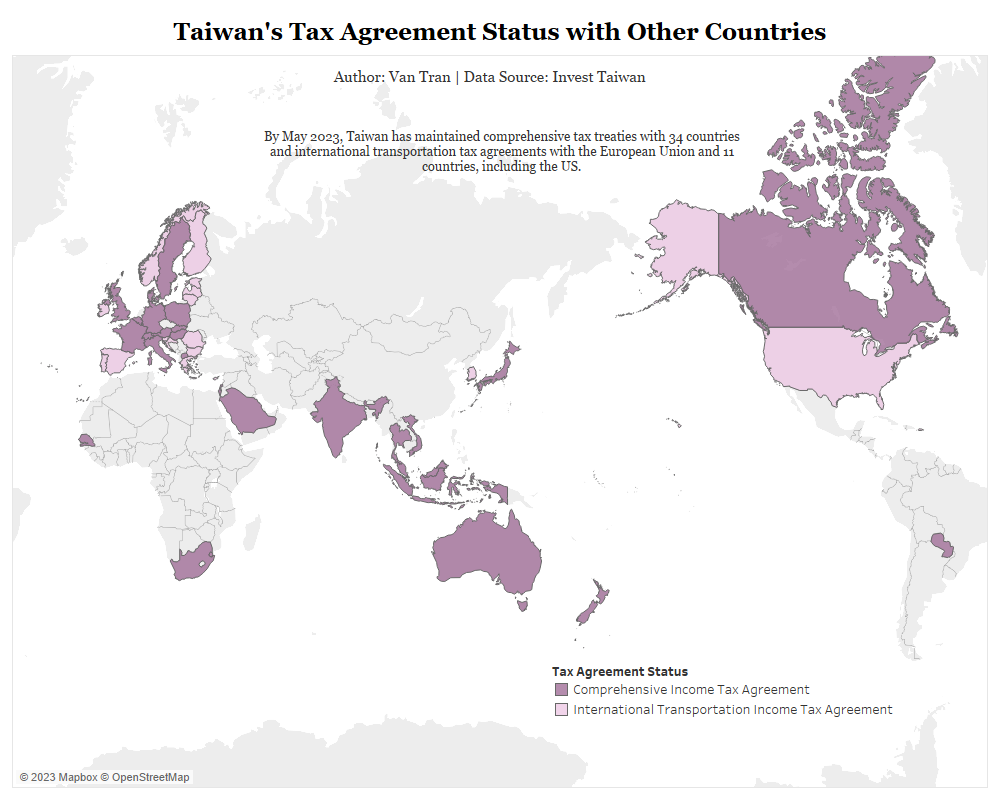

Taiwan has signed international transportation income tax agreements with major trading and investment partners such as the USA, Japan, EU, and Canada, but is still seeking to sign comprehensive income tax treaties with these major economies. The lack of formal diplomatic relations between the United States. and Taiwan has been a major hindrance to the double taxation agreement – since Taiwan’s unique status precludes it from the process of remedying double taxation through a treaty.

Graph made by Van Tran | Data source: Invest Taiwan

The United States maintains tax treaties with 65 other countries, yet Taiwan, which consistently ranks among the top 10 American trading partners, is the only entity in that category without a double-taxation avoidance mechanism with the United States.

A tax agreement seems to be a suitable remedy, and solid arguments have been made in its favor. According to the American Chamber of Commerce, Taiwanese companies that invest in securities issued by U.S. corporations and receive dividends are subject to a 30% withholding tax rate. If the United States. and Taiwan concluded a double taxation agreement, this rate would only be 10%. The agreement would ease the cost of doing business and facilitate the circulation of talent between the United States and Taiwan, leading to more job creation and offsetting revenue lost to the Treasury.

President Tsai Ing-wen told US Senator Ed Markey (D-MA) that such an agreement is one of her priorities when the Senator led a delegation to visit Taiwan in August 2022.

The Taiwan Tax Agreement Act of 2023 has been presented as the solution. The bill is expected to strengthen cooperation, benefit American and Taiwanese businesses and taxpayers, and promote bilateral investment and trade.

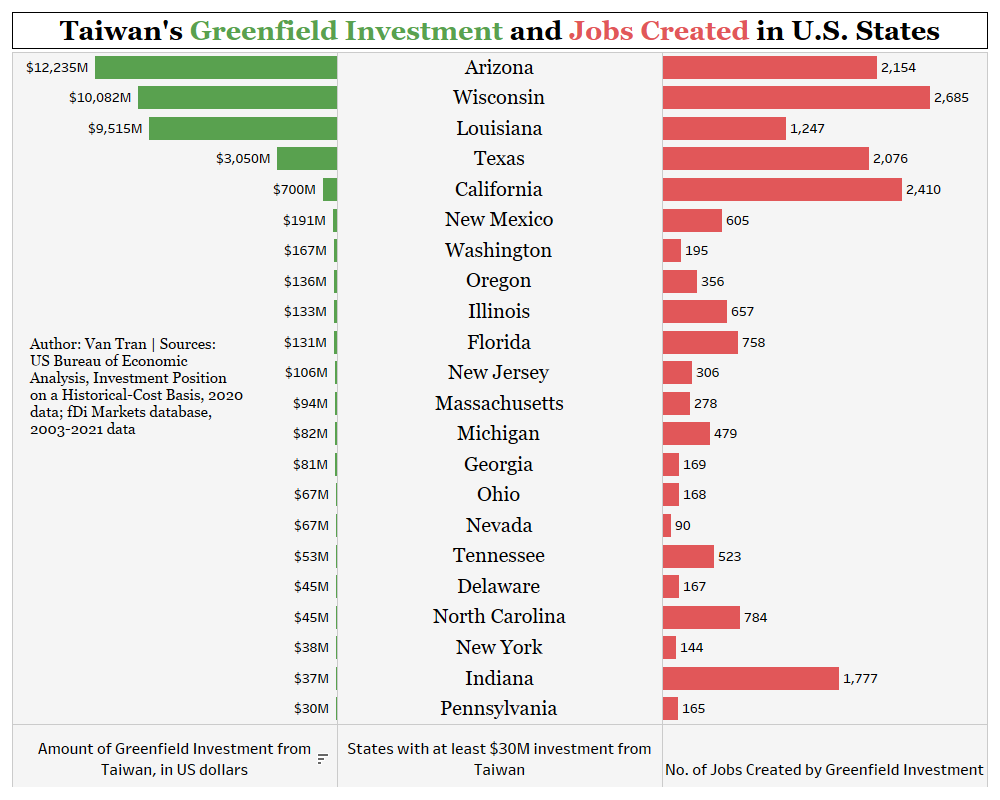

Graph made by Van Tran | Data source: Senate Resolution 91

The tax agreement, if concluded, would include elements similar to those found in US income tax treaties with other countries, including relief from double taxation, limitation or avoidance of tax evasion, and entry into force conditioned upon approval by the United States Congress and authorities in Taiwan.

The Taiwan Tax Agreement Act, if passed, would positively impact businesses, particularly in the 28 US States that have received greenfield investment from Taiwan. Texas, Louisiana, and Arizona would benefit the most from future tax agreements, as each state received over $1.1 billion in Taiwanese investment. The reduction of tax-related barriers would also support Taiwanese investments that have created thousands of jobs in Arizona, Wisconsin, and California.

Industries that would benefit from the tax agreement include semiconductors and manufacturing technologies such as electric vehicles, Internet of Things, 5G equipment, and aerospace technology. Large Taiwanese semiconductor companies such as TSMC in Arizona, Foxconn in Wisconsin, and Formosa in Louisiana would have more incentive to expand their US presence if the financial strain of double taxation is relieved.

Graph made by Van Tran | Data source: Taiwan Matters for America 2022. More details in graph.

The need for a U.S.-Taiwan double taxation agreement is not new, considering that Stephen Young, the former director of the American Institute in Taiwan, first proposed the idea around 15 years ago. As Taiwan continues to develop its technology sector, the United States will become an even more important partner for the island nation. The tax agreement can serve as a steppingstone for further economic cooperation between the two countries.

Van Tran is a participant in the Young Professionals Program at the East-West Center in Washington. She is an undergraduate student majoring in International Studies at Rhodes College, with a concentration in democracy & governance, Asian Studies, and immigration.